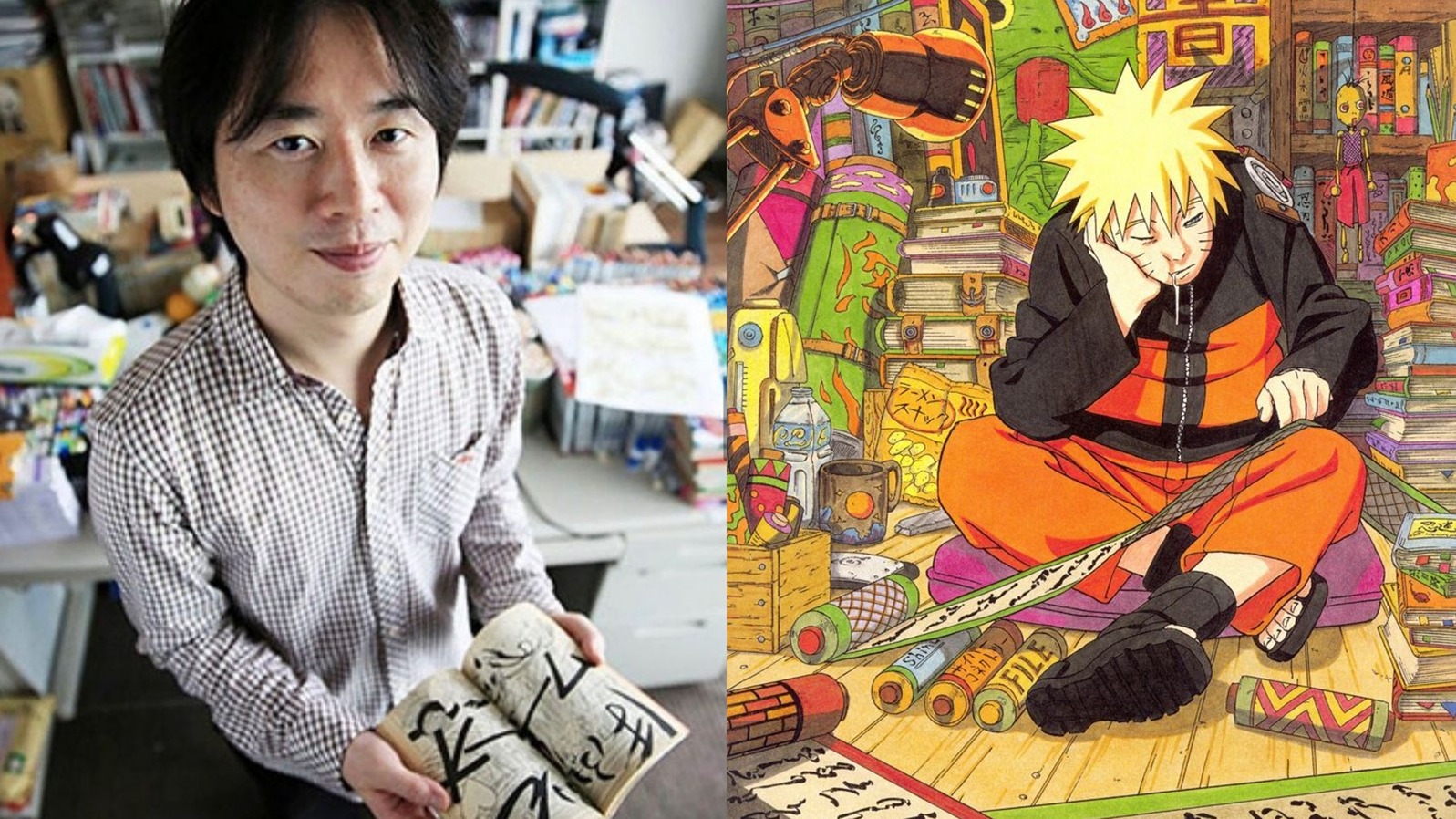

Naruto Creator Masashi Kishimoto to Make Rare Convention Appearance in France

Masashi Kishimoto, the renowned creator of Naruto, will step into the spotlight with a rare appearance at a convention in France. Fans around the world are eagerly awaiting the chance […]