New Trailer Introduces Meme Bashame in My Deer Friend Nokotan Anime

Hold on tight as My Deer Friend Nokotan introduces another quirky addition to its cast: Meme Bashame, voiced by Fuka Izumi (known as Rin Rindo in HIGHSPEED Étoile). Let’s take […]

Hold on tight as My Deer Friend Nokotan introduces another quirky addition to its cast: Meme Bashame, voiced by Fuka Izumi (known as Rin Rindo in HIGHSPEED Étoile). Let’s take […]

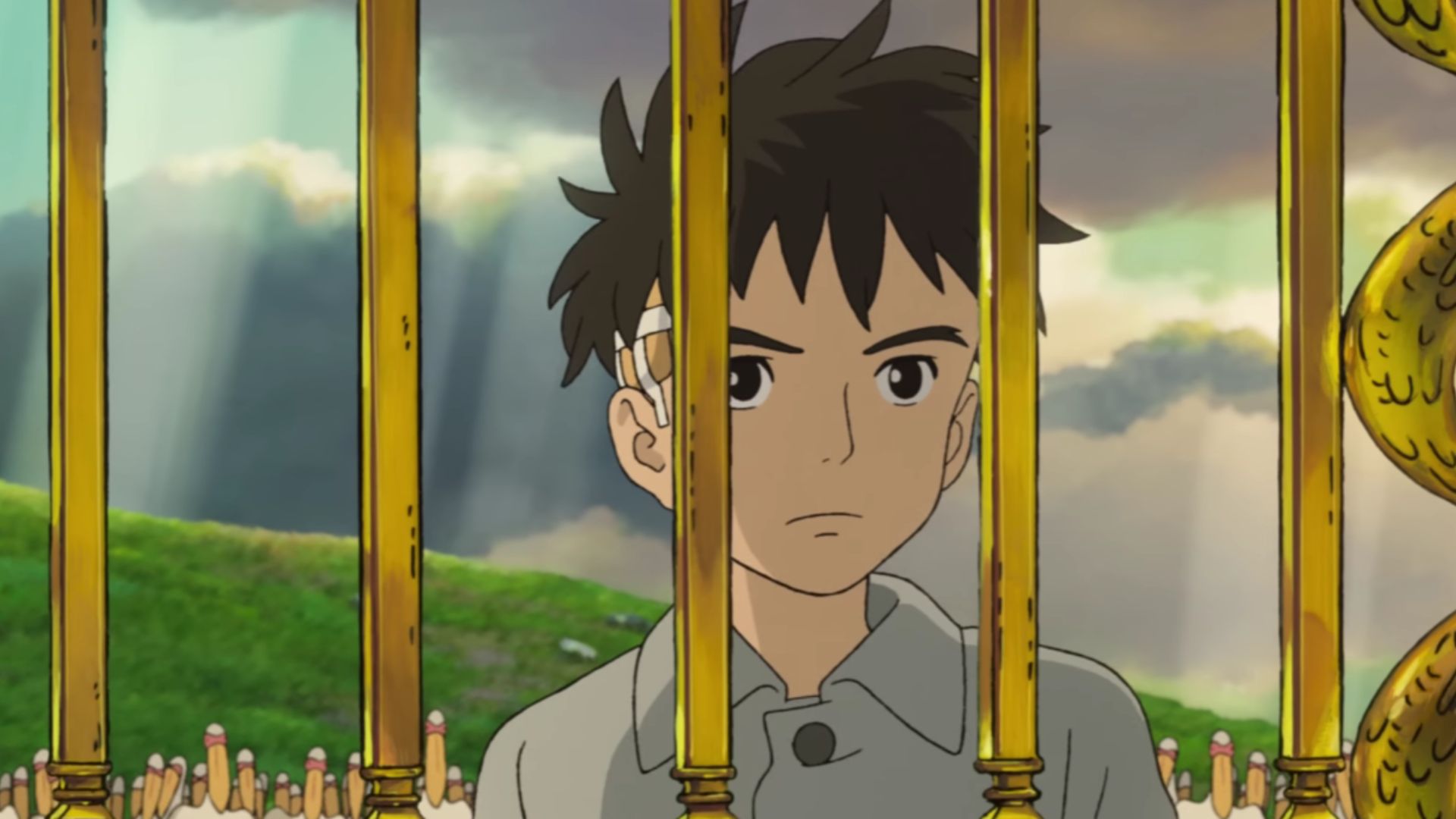

Warner Bros. India took to Twitter on Monday to announce the upcoming release of Hayao Miyazaki’s latest feature film, The Boy and the Heron, in Indian cinemas. The film will […]

Naruto Shippuden Hindi Dubbed Download Sony Yay is an anime series that follows Naruto in his next journey.(Naruto Shippuden Hindi Dubbed Sony Yay Release Date) | Naruto Shippuden Hindi Dubbed […]

Mikakunin de Shinkoukei Chapter 186 Explained: The Chapter 186 opens with Kobeni and Hakuya sitting outside at night gazing upon the stars together, admiring how lovely Kobeni finds it to […]

My Wife Is From a Thousand Years Ago Chapter 264: In the latest chapter of the manga “My Wife is from a Thousand Years Ago”, the story continues to follow […]

A new anime called Astro Note will hit the screens soon. Created by Telecom Animation Film and Shochiku. This original series follows the journey of Miyasaki Takumi as he takes […]

Takako Shimura took to Twitter on March 21 to announce that Hitorigurashi’s previously published Futari (Living Alone Together) one-shot manga will receive regular serialization. The series will debut in the […]

Jujutsu Kaisen stands out as one of the most beloved shonen series of our time, celebrated for its gripping action, intricate power system, and diverse, memorable characters. Centered around Yuji […]

Metallic Rouge Episode 12: Release Date, Recap & Spoilers: In the previous episode, we got a glimpse of Eva’s nostalgia-filled birthday party as Jill (Silvia) joined the celebration aboard the […]

The long-awaited episode 13 of Delicious in Dungeon is scheduled for release on March 28, 2024 and promises to reveal the enigmatic identity and true nature of the elusive “Mad […]